Bookkeeping Services For Startups: Choosing the Right Bookkeeping Services Provider

Bookkeeping Services For Startups: Choosing the Right Bookkeeping Services Provider

Blog Article

Invoicing And Bookkeeping Services: Handling Your Small Business'S Financial Records Is Vital For Its Success

Choosing The Right Accounting System

Navigating the labyrinth of accounting systems can seem like a challenging quest, especially for the budding business owner. It's not simply about crunching numbers; it's about finding a rhythm that resonates with your organization's distinct heart beat. Consider it this way: would a master chef utilize a blunt butter knife to julienne veggies? Of course not! Similarly, your bookkeeping system needs to be the sharpest tool in your monetary toolbox.

Handbook vs. Digital: The Age-Old Argument

For some, the soothing rustle of paper journals and the systematic click of a pen provide a sense of control. This conventional approach, typically involving spreadsheets or even physical journals, can be extremely intuitive for those with really low transaction volumes. It belongs to tending a small garden by hand-- every plant gets private attention. Nevertheless, as your service blooms, the large volume of invoices, invoices, and payments can rapidly transform that tranquil garden into an overgrown jungle. Mistakes multiply, reconciliation becomes a Burden, and suddenly, your valuable time is swallowed by administrative quicksand. Is this actually the very best use of a little organization owner's day?

The Digital Leap: Cloud-Based Solutions

The digital age has actually ushered in a plethora of cloud-based accounting services, revolutionizing how small services handle their finances. These platforms provide exceptional benefit, permitting you to access your financial information from essentially anywhere, at any time. It's like having a financial assistant living in your pocket, always ready to upgrade ledgers or generate reports. This ease of access is a game-changer for business owners who are constantly on the move, managing multiple obligations. Furthermore, these systems frequently automate laborious tasks, from classifying expenses to reconciling checking account, significantly reducing the capacity for human mistake. Think of the comfort knowing your books are constantly up-to-date, ready for tax season or an impromptu financial evaluation.

When considering a digital solution, ponder the following:

- What is your comfort level with technology?

- The number of deals do you process monthly?

- Do you need to integrate with other business tools, such as point-of-sale systems or payroll software?

- What level of monetary reporting do you require?

- How essential is automated invoicing and expense tracking?

Scalability and Assistance

A crucial, yet frequently ignored, aspect of selecting an accounting system is its scalability. What works for a solo venture today may buckle under the weight of a growing business tomorrow. Your chosen system should have the ability to progress with your service, accommodating increased deal volumes, additional users, and more complicated financial requirements. Think long-term. Will this system still serve you well when your business employs five people, or fifty? Consider the schedule of client assistance. When you come across a snag, having easily accessible assistance can be a lifesaver, transforming minutes of frustration into swift resolutions. Keep in mind, the best accounting for small company system is not just a tool; it's a tactical partner in your journey to financial clearness and continual growth. It should streamline, not complicate, your monetary life.

Recording Financial Transactions Properly

The bedrock of any flourishing small company? Impeccable record-keeping. Think about your monetary transactions as the heartbeat of your business; if it skips a beat, or worse, flatlines, you remain in for a rough ride. Lots of entrepreneurs, often teeming with enthusiasm for their item or service, find themselves adrift in a sea of invoices and invoices. Ever heard the one about the shoebox loaded with crumpled papers? It's not simply a cliché, it's a typical truth for numerous fledgling organizations, resulting in a scramble when tax season looms or when seeking financing. What good is a brilliant idea if its financial foundations are unsteady?

The Danger of Unreconciled Accounts

Among the most significant difficulties little organizations encounter is the chasm in between their bank statements and their internal records. This inconsistency, frequently subtle in the beginning, can grow out of control into a huge task, obscuring the true financial health of the company. Imagine trying to browse a thick fog-- that's what unreconciled accounts seem like. Forgetting to log a small, repeating membership, or miscategorizing a big purchase, can toss off your entire system. The ripple effect extends beyond mere inconvenience, impacting everything from money circulation projections to precise earnings and loss statements. Do you really understand where every dollar goes, or where it comes from?

To circumvent this typical pitfall, consider these professional insights:

- Daily Discipline: Make it a non-negotiable habit to log transactions daily, or at the really least, every other day. This isn't about being obsessive; it's about preventing a mountain from forming out of molehills.

- Classification is King: Develop a consistent, clear chart of accounts from the beginning. This typically neglected action is paramount. Are those office supplies an administrative expenditure or a marketing cost? Clarity here saves immense headaches later on.

- Digital Tool Utilization: While a spreadsheet may be enough for the really tiniest operations, investing in devoted bookkeeping software can be a game-changer. These platforms automate much of the data entry and reconciliation, substantially reducing human mistake. Think of it as having a steadfast assistant dedicated exclusively to your finances.

- Regular Reconciliation: Do not wait up until month-end. Reconcile your bank and credit card declarations with your internal records weekly. This proactive method permits you to catch errors or disparities while they are still small and easily rectifiable. A quick check now conserves hours of detective work later on.

Understanding the nuances of financial deal recording isn't just about compliance; it has to do with empowerment. It gives you the clearness to make informed choices, identify costs trends, and determine locations for growth or expense reduction. Without precise information, your company choices are, at best, educated guesses. With it, you possess a powerful compass assisting you through the often-turbulent waters of entrepreneurship. Keep in mind, every cent narrates; guarantee yours is a real and accurate story.

Managing Payroll and Expenses: The Silent Earnings Drain

Ever seem like you're continuously chasing after invoices, playing investigator with bank statements, and wondering where all your hard-earned money vanishes? For lots of little company owners, the seemingly straightforward job of handling payroll and expenditures becomes an overwelming labyrinth, a silent earnings drain that siphons away precious resources. This isn't simply about balancing books; it has to do with safeguarding your monetary health. Think about it like a leaking faucet: separately, each drip seems irrelevant, but in time, it clears the entire tank. The most significant difficulty typically isn't the complex estimations, but the large volume and varied nature of transactions, making it remarkably simple for things to slip through the cracks. Are you thoroughly tracking every single overhead, or are some falling by the wayside, costing you possible tax reductions?

One typical risk is the commingling of individual and organization funds. It's a routine many brand-new business owners fall under, a blurred line that makes precise expenditure tracking an absolute headache. Envision trying to discuss to an auditor why your grocery bill from last Tuesday is intertwined with your workplace supply purchases. This relatively innocuous practice can lead to considerable headaches down the line, not just with tax authorities however likewise in comprehending your true profitability. How can you gauge the health of your organization if you don't have a clear photo of its financial inputs and outputs? Different savings account and charge card are non-negotiable. This isn't just an idea; it's basic to sound accounting for small company. Consider the often-overlooked area of staff member cost reimbursements. Without a robust system, these can rapidly become a source of disappointment and inaccuracies. Do your staff members comprehend the appropriate treatment for submitting expenditures? Exists a clear approval procedure in place?

Simplifying Your Expenditure & & Payroll Processes

The solution depends on efficient systems and a proactive mindset. For payroll, consider the advantages of direct deposit over paper checks; it reduces administrative problem and provides a clear audit path. Guarantee you comprehend the nuances of classifying workers versus independent professionals; misclassification can lead to substantial penalties. For expenses, the power of digital tools can not be overstated. Ditch the shoebox filled check here with crumpled receipts! Mobile apps developed for expense tracking permit you to snap a picture of an invoice, classify it, and even attach it to a specific task or client, all in real-time. This not just conserves you time however likewise ensures precision and makes year-end tax preparation significantly less complicated. What's more, carrying out a clear expenditure policy for your group, describing what is reimbursable and what isn't, can avoid disagreements and misconceptions before they even emerge. A well-defined policy serves as a compass, guiding everyone towards compliant and efficient costs.

- Make use of devoted company savings account and charge card.

- Implement digital cost tracking software for real-time capture.

- Automate payroll procedures to reduce mistakes and conserve time.

- Establish a clear, written expenditure compensation policy for employees.

- Routinely reconcile bank declarations with your accounting records.

Keep in mind the expression, "What gets determined gets managed." Without exact cost tracking and precise payroll management, you're essentially flying blind. You will not truly understand your revenue margins, nor will you be able to make informed decisions about development or cost-cutting. This isn't practically compliance; it's about tactical financial insight. Are you truly maximizing your deductions? Exist investing patterns you're unaware of that could be optimized? The time bought establishing robust systems for handling payroll and expenditures will pay dividends, releasing you to focus on what you do finest: growing your business.

Generating Financial Reports: The Unsung Hero of Small Company Bookkeeping

Ever felt like you're navigating a dense fog, attempting to make crucial service decisions without a clear view? That's precisely what occurs when you neglect the power of well-generated monetary reports. Many little business owners, naturally swamped with daily operations, view these reports as mere compliance files. What if I told you they are, in reality, your most powerful compass?

The Genuine Obstacle: Disorganized Data

The main stumbling block for a lot of isn't the act of generating the report itself, however the chaotic, scattered information that precedes it. Envision trying to bake a cake with components strewn throughout the kitchen area, some missing, others ended. That's the reality for lots of who have not embraced meticulous bookkeeping from day one. Transactions are logged haphazardly, invoices go missing, and bank reconciliations end up being Herculean tasks. This chaos undoubtedly drips down, making the development of precise monetary declarations an aggravating, error-prone endeavor. How can you truly understand your business's health if the very details you're depending on is flawed?

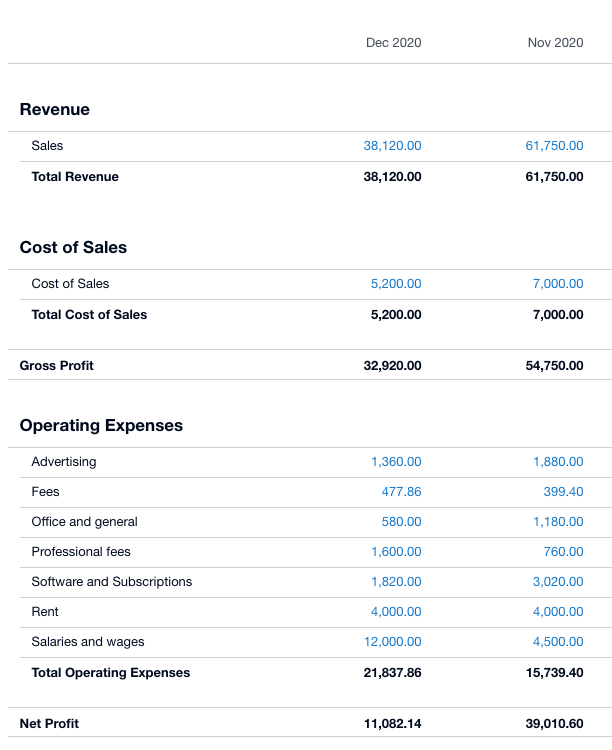

- Earnings and Loss Statement (P&L): This isn't almost what you earned and invested. It narrates. Is your gross profit margin shrinking? Are business expenses spiraling out of control? A keen eye on your P&L can expose if your pricing method is efficient or if you're spending beyond your means on marketing that isn't yielding returns.

- Balance Sheet: A snapshot of your financial position at a particular minute. It information your assets, liabilities, and equity. Consider it as your company's net worth. Are your receivables growing too large, suggesting collection concerns? Is your financial obligation manageable? This report offers critical insights into your liquidity and solvency.

- Money Flow Declaration: Often neglected, yet probably the most crucial. A successful company can still go under if it runs out of cash. This report tracks cash being available in and heading out, revealing if you have enough liquid funds to cover your commitments. It addresses the sixty-four-thousand-dollar question: where did the cash go?

Professional Tips for Flawless Reporting

To produce significant monetary reports, cultivate a practice of everyday or weekly data entry. Don't let deals pile up; it resembles attempting to bail out a sinking ship with a thimble. Reconcile your checking account and credit cards consistently. This isn't just about capturing errors; it's about ensuring every cent is represented, supplying the pristine data required for accurate reporting. Think about implementing cloud-based accounting software. These platforms automate much of the data entry and reconciliation, considerably lowering manual mistakes and saving invaluable time. They also offer adjustable report design templates, making the generation process practically effortless. Remember, the clearer your data, the sharper your insights. What story do your numbers tell about your company's future?

Report this page